Well I’m back!!! A trip to Ireland for some golf and R&R. Yes, it’s absolutely true, Guinness tastes way better over there than it does here. Some say it’s the water, the Guinness staff will tell you that Guinness doesn’t travel well. I’m not sure what it is, but I can see why this is the national beverage of choice. 4 million people in Ireland drink 2 million pints a day. That’s impressive. If you’ve ever been to Dublin you’ll see the factory, which takes up a big part of the town. Interestingly when Arthur Guinness built the factory, he wanted the water supply that came with it. The town decided that they would not sell him the land, but they decided to lease it to him. So, he signed a 9,000 lease for the sum of $45 Pounds a year, and that lease is still in operation today. A copy of the original lease is right in the foyer when you walk in the factory.

I added another designation to my portfolio while I was there…I’m now a certified Guinness pourer. Believe it or not I passed the course with flying colors. Pictures won’t show how gorgeous this place really is, but I’ve added a couple below.

A stack of news while I was away, however the market had a recent rally on what I believe is due to earnings. It all comes back to earnings eventually, however that has not been the case for the past 12 to 18 months. Excessive stimulus, Wars, Supply Chain issues, have added volatility far above and beyond what the true earnings effects will be.

My headline BTF, stands for “Better Than Feared”. Earnings forecasts have been, and will continue to come down, as higher production costs, as well as a slower consumer will affect future earnings. However, I believe the pessimistic attitude is a little overblown and earnings (although slowing) are coming in better than feared. It’s often quoted that when pessimism is high, that’s a great time to buy. The industry calls it a contrarian indicator.

Markets overshoot in both directions, and this recent pullback has pulled Price to Earnings multiples back to long term averages. The bears out there will tell you that we are in a recession, and that’s bad for stocks. Of course it is…the real issue when it comes to trying to beat a stock market index is, when is it time to be conservative and when should you be more aggressive? Whether or not we have seen the lows, now is a much better time than January 3rd to take a more aggressive stance.

Here’s what my gut tells me from here:

I feel inflation numbers in July will begin to come down from the June 9.1%, a 4-decade high. Although I was wrong last month. However, it will likely linger higher for longer. The Feds action of tightening takes 6-9 months to really play out, therefore the effects of a slowing macro economy will likely take time to play out. When earnings start to be affected, companies will start to take measures to protect themselves, which will look like hiring freezes and eventually an increase in the unemployment rate. We are not there yet.

This will be a process, it’s not going to be a situation where everything is fixed overnight, it will likely take some time to pan out. The most important thing that I want you to take away from all of this is, the market will most likely already have rallied before the economic numbers confirm the positive data. That’s investing!!! This is why Buffett tells you to be greedy when others are fearful.

This is all setting up well for my initial thesis of a rally in equities when we get some certainty on the outcome of the mid-terms. Not because of any one party or another, rather the market loves consistency. If Republicans win the House or Senate, we are looking at gridlock politically. Markets love this, cause nothing gets done. We are starting to see the ads running now, however it’s still for primaries. The mid-term advertising will be in full swing soon enough.

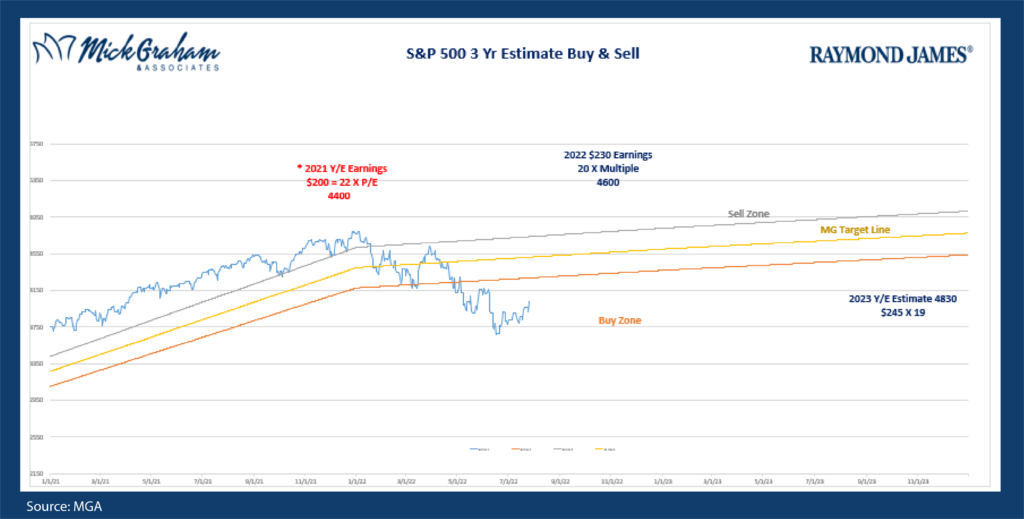

With all that said, it’s great to be back and refreshed. Here’s the buy/sell.

Mick Graham, CPM®, AIF®

Branch Manager Raymond James

Financial Advisor Melbourne, FL

Any opinions are those of the author and not necessarily those of Raymond James. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. All opinions are as of this date and are subject to change without notice. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including asset allocation and diversification. Past performance is not a guarantee of future results.