The most telegraphed fiscal announcement occurred last Wednesday with the Federal reserve raising the Fed funds rate 25 basis points. This move, likely to be the first of many rate hikes this year, is one of the many tools that the Treasury and the Fed have to keep economic conditions (in the U.S.) in the sweet spot.

The sweet spot is somewhere in the 3% growth category, over the long term. In the Chairman’s speech yesterday, he referenced the economy was growing at 5.5% year over year and step will need to be taken to put the brakes on. What’s this all mean for the capital markets? Here’s a quick refresher.

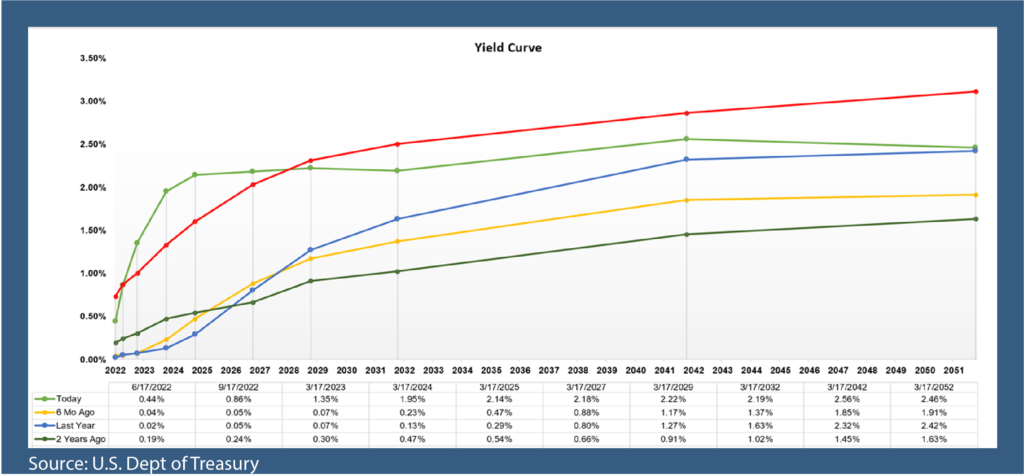

The Fed controls short term rates, which is basically the rate that banks borrow from each other. The “free” market controls the rest of the yield curve. Meaning if you want to buy a bond longer than 1 day, then the price you pay for that bond will be based on supply and demand. When we talk about rates, we base everything on U.S. Government bonds, they are considered guaranteed. All other bonds (by companies, municipalities) are based on that particular company’s/municipality’s full faith and credit, therefore in normal market conditions will trade at higher-yields the lower their credit rating is from the AAA rating of Government bonds.

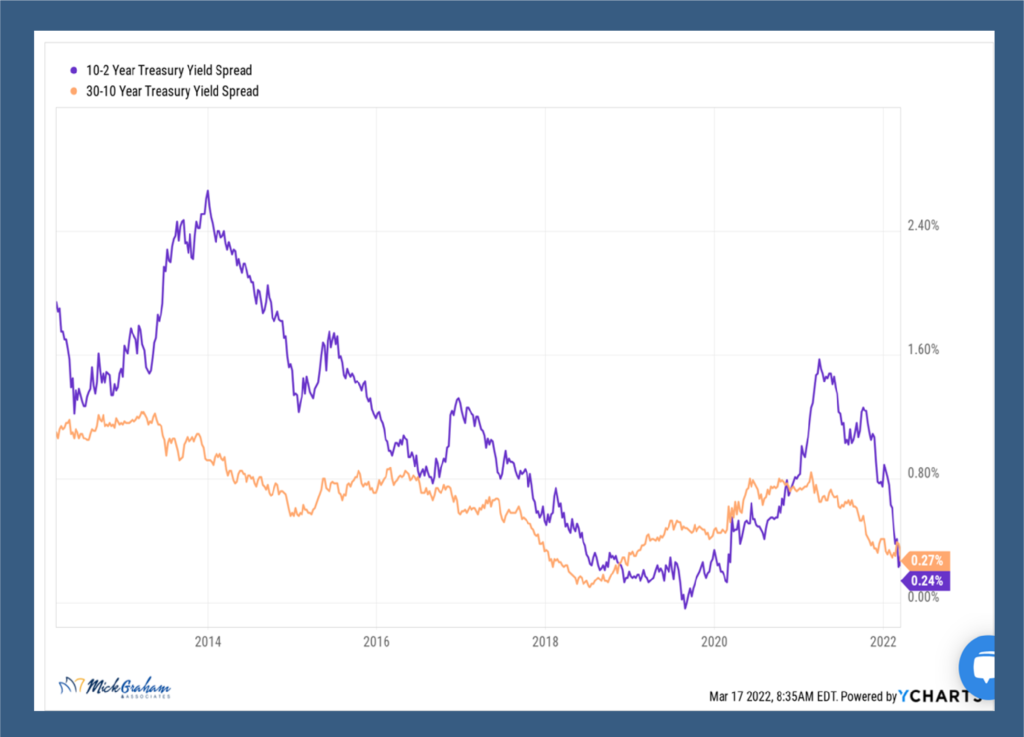

Of course, as markets do, they had already pre-priced these moves, and shorter-term yields had already moved up in anticipation. Different story for long rates, however. The spread between the 2-year bond and the 10-year bond is as low as it’s been since 2019. Looking longer the spread between the 10-year and the 30-year fast approaching the lowest level in almost 15 years. This is the market sending you a message that it’s not as confident in a global recovery as the Fed.

As it relates to the fixed income markets, I expect to see rates creep higher especially if we get some type of cease fire, and global trade clearing the bottle necks on supply. That means it will be really tough to make money in the bond market. In my opinion, I actually think the next few years may be negative. Especially in bond funds….I’ve talked to exhaustion on bond funds.

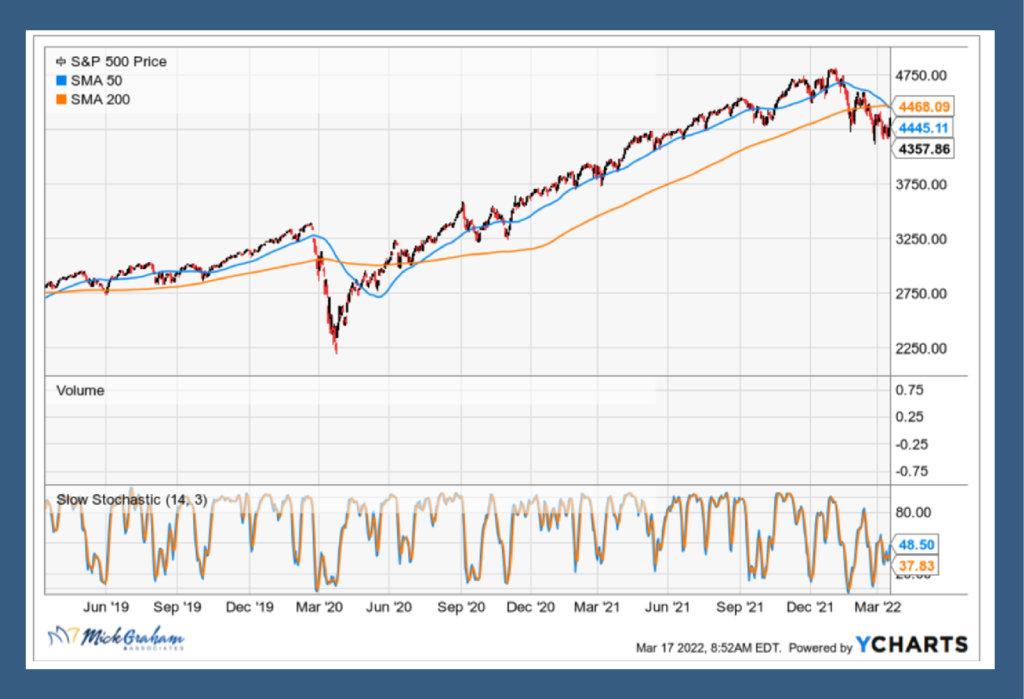

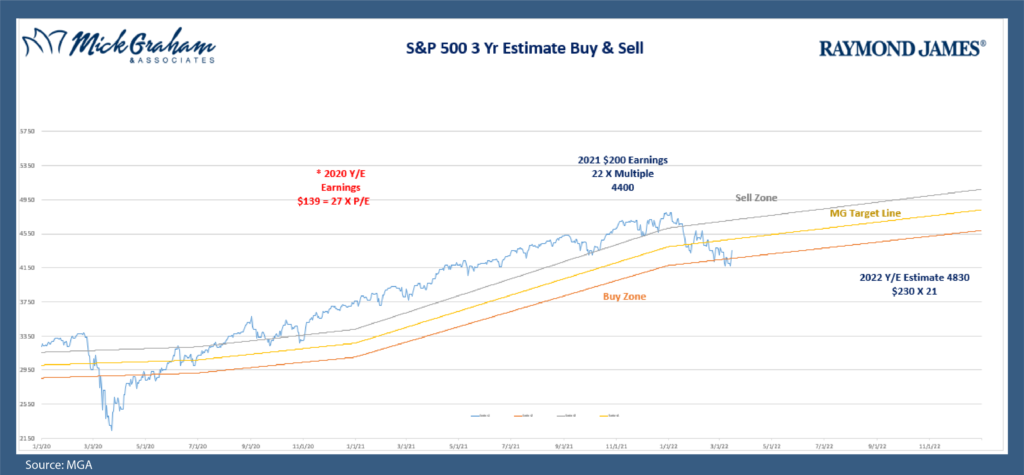

Equity markets are different. Inflation is eventually passed on to the consumer, which then forces wages up, and that extra money flows through the economy helping profits. It all comes back to earnings, which so far are doing very well. We are still seeing earnings above expectations, and long-term forecasts are still seeing double digit gains. This basing that the market is currently going through, appears to be setting up the second half of the year and beyond for nice returns. Earnings and gridlock will be the theme for the second half of 2022 and all of 2023.

Till then it’s likely we will see more volatility. In these big swing days, there is great opportunity to add some great companies at a nice price….with all that, here’s the Buy/Sell.

HWFFS

I’m struggling this week to find inspiration. The images being shown of the devastation in Ukraine bought me to tears this week. I know I’ve told you before that the market does not have a soul. It doesn’t. It will continue to push forward digesting all the news and will attempt to look beyond it. That’s what it does, but that’s not human. Raymond James this week gave a $100,000 donation to the Red Cross for humanitarian relief efforts, which was very cool, but no amount of money will fix what Putin decided to do. We’ve seen these regional conflicts many times before, but this one feels different, and I’m not sure why. I just hope and pray that the needless killing of civilians will stop.

Mick Graham, CPM®, AIF®

Branch Manager Raymond James

Financial Advisor Melbourne, FL

Information contained herein was received from sources believed to be reliable, but accuracy is not guaranteed. Information provided is general in nature and is not a complete statement of all information necessary for making an investment decision and is not a recommendation or a solicitation to buy or sell any security. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success. Any opinions are those of and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Investments mentioned may not be suitable for all investors. There is no assurance these trends will continue, or forecasts will occur. The S&P 500 index is comprised of approximately 500 widely held stocks that is generally considered representative of the U.S. stock market. It is unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. There is an inverse relationship between bond prices and interest rate movements. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.