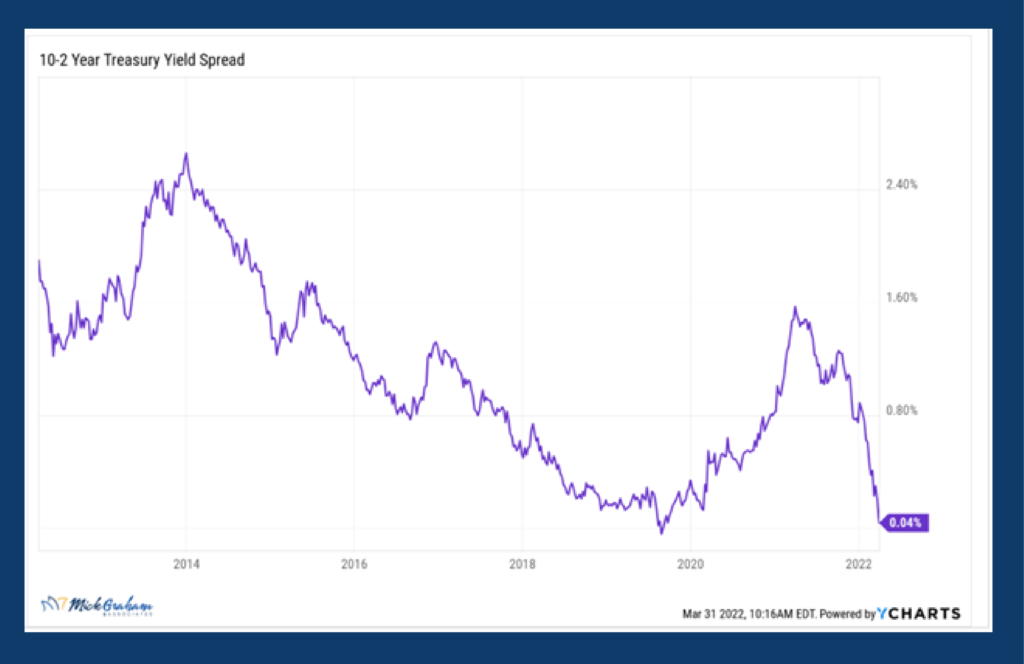

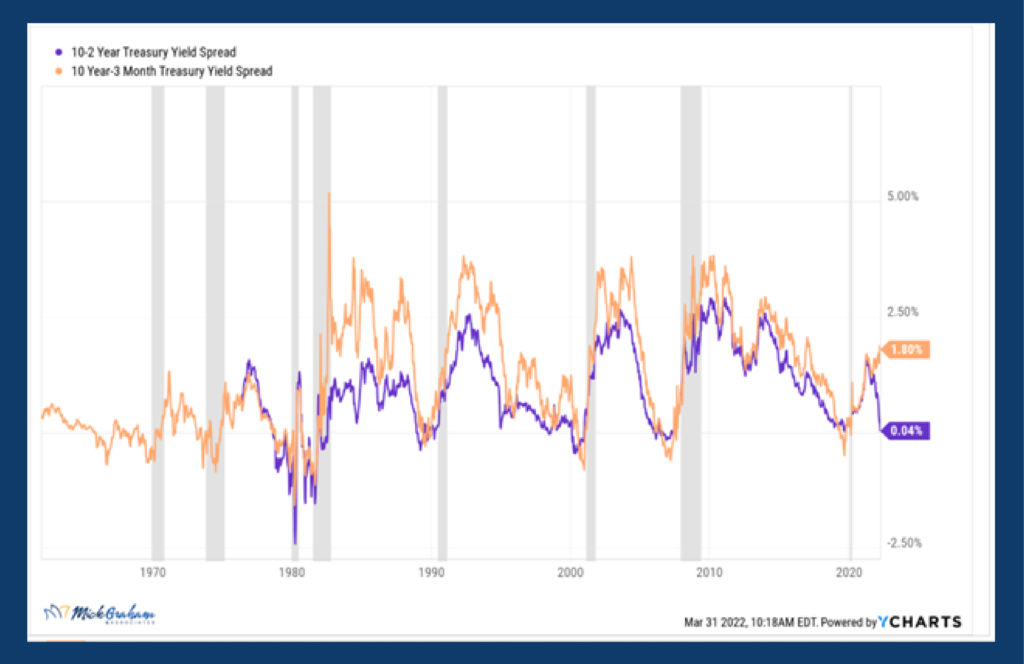

There is a lot of talk about the inversion in the yield curve this week with the difference between the 10- year U.S. treasury and the 2-year looking to touch inversion levels. (Meaning you get less return for taking 10 years of risk than you do for taking 2 years of risk). This has and will inevitably have the talking heads talking recession, as there has been some correlation between the 10-2 inverting and recession.

My bet is that this is more of an indication that the market feels like the Fed will be raising quickly, probably quicker than it has in the past, thus pushing the 1-2 year yields higher. What is providing a different signal is the 10-3month spread. This has widened to a to a level that has been an indicator of good economic times.

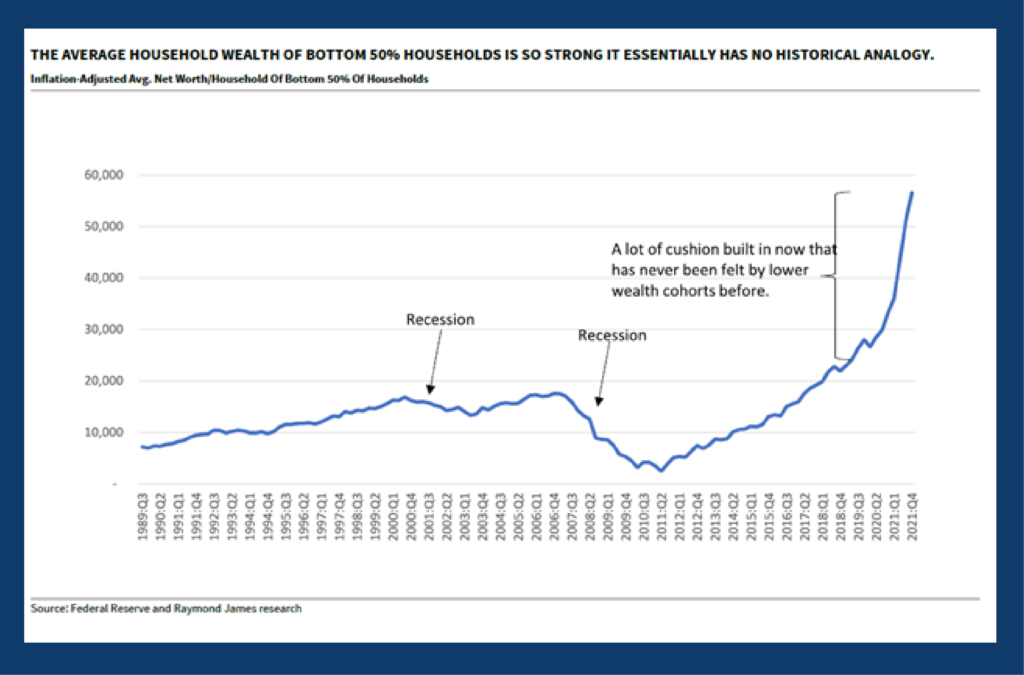

Very conflicting data points. I would tell you at this stage, don’t read too much into it. We are and have pretty much always been a consumer led economy. Specifically led by the low-end consumer. This past week our strategy team released a great report on the low-end consumer and although I’m going to reference a few charts from it.

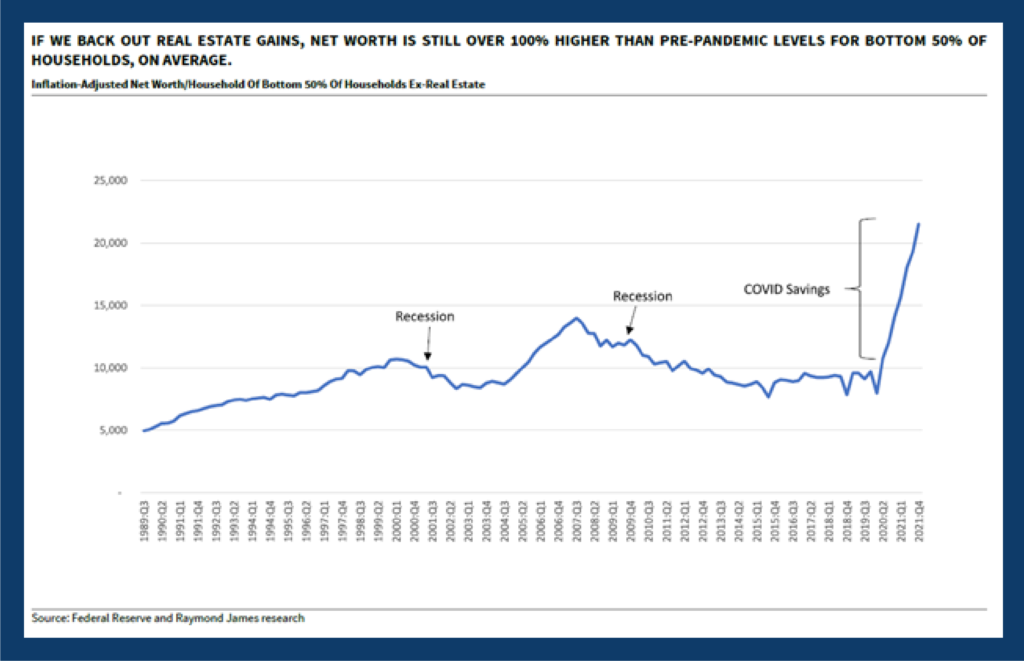

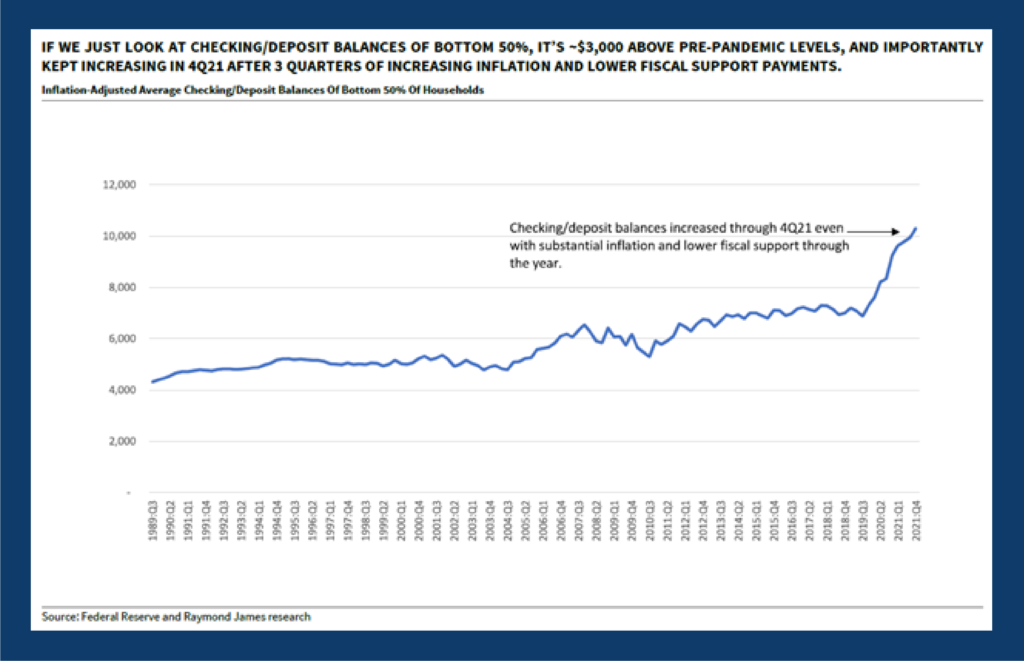

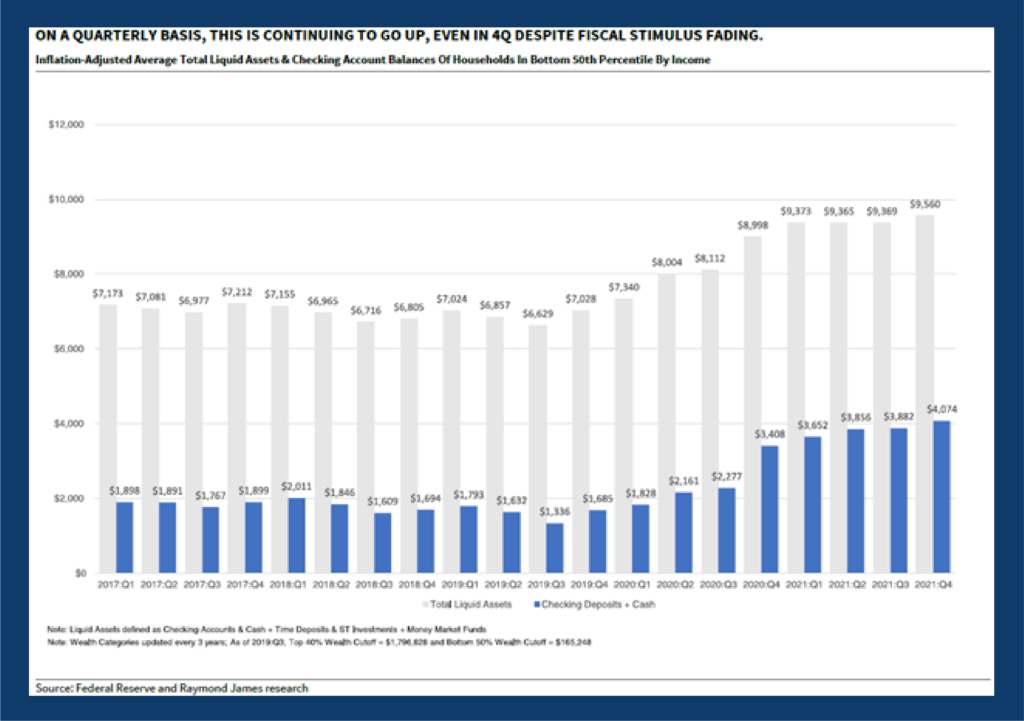

In short, this demographic has such strong economic strength, it has no analogy. Adjusted net worth has doubled in the last two years, savings rates are 100% higher than pre-pandemic levels, balances in checking accounts are 50% higher and that figure is continuing to rise despite fiscal stimulus fading.

Although wages have increased at a high level for this space in the past year, Real Wage Growth, which takes into account inflation is actually -1%. Even with this data, it would take over 6 years to burn off the excess level of savings, signaling that the spending rate should stay at elevated levels for some time.

There were interesting comments from CEOs of companies that target the low-end consumer. You can read actual comments in the report, however summarizing they state they would normally see a shift in how consumers are spending in tougher times, a trade down in quality, however there is no sign of that yet.

We are starting to see demand for low-end, big-ticket items (I know sounds strange)— but think of mattresses etc. start to slow down. Obviously if you got a mattress last year, you don’t need another one this year. Restaurants are seeing strong growth as the country opens up fully without restrictions. We are seeing a shift from goods (as mentioned above) to services. Investopedia sums up the service sector pretty well, click here to read.

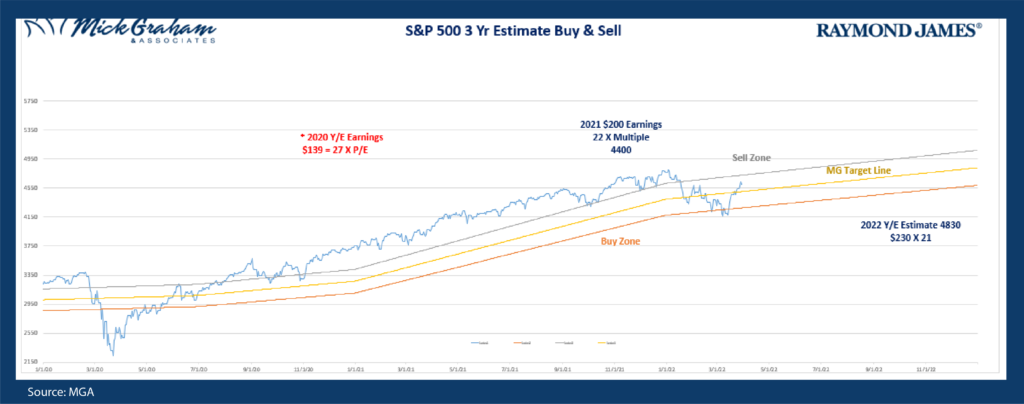

Summing up, with the economy in good shape, I believe we will clear some of the signals that signal tougher times in the 2nd quarter and pave the way for some gridlock come the end of the year, leading into a strong 3rd year of a Presidential term that has a 90% positive return rate. (Source: Global Financial Data).

With all that here’s the buy/sell.

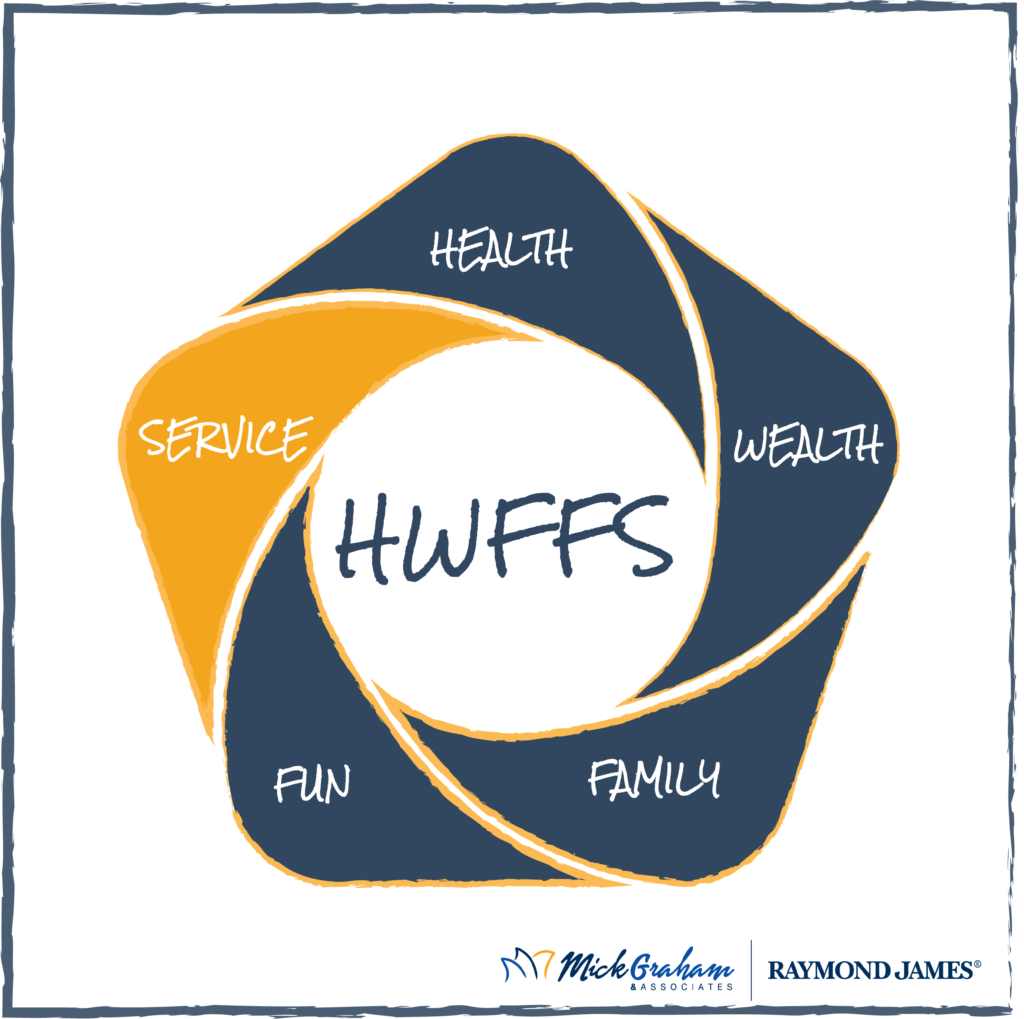

HWFFS

Service

Got to present a check through our charity Brevard Random Acts of Kindness last week. We were tasked with looking for a deserving local business that struggled through the pandemic. Believe it or not it was harder to source than you think. Some businesses did well through the pandemic, such as businesses that cater to outside activities. Then there were businesses that received stimulus checks. However, there were some that just did not check any of the boxes to receive help. We found a local business that pretty much lost everything, including the owner’s house and car, and unlike most of us who would’ve given up and gone back to work for an organization again and attempt to dig herself out of a hole, Jessica decided to start again. Through our great community we were able to raise $5,600 that will cover the next 7 months of her business rent and hopefully helps her to get back on her

feet. If you want to read more about her story click here.

Kindness is Cool!!!!

Mick Graham, CPM®, AIF®

Branch Manager Raymond James

Financial Advisor Melbourne, FL