No, I’m not talking about a new TikTok trend. The market did it again. Despite Omicron variant, despite the stuff Powell spews out, the market (as indicated by the S&P 500) fell back to the 50-day moving average and then quickly bounced off it. 8th time this has happened this year, and each time has proven to be a buying opportunity.

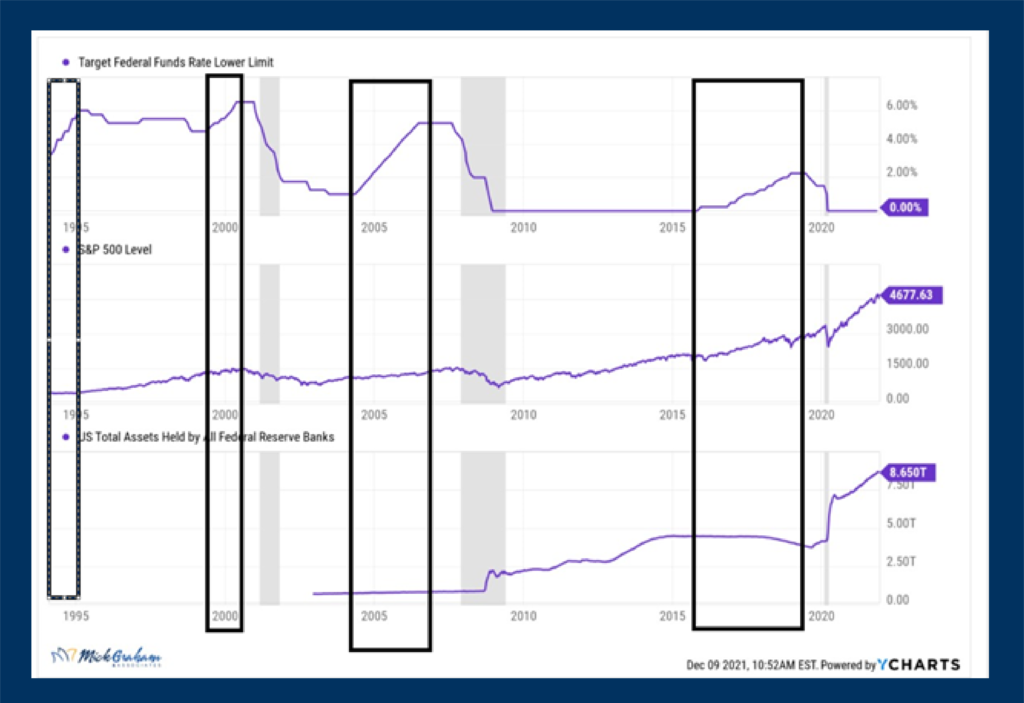

Next step, if this short-term momentum continues will be to retest the recent highs. It’s amazing how resilient the market is being with all sorts of things being thrown at it. The percentages are pretty high that we will see an accelerated tapering and a rate rise (or two) in 2022. Despite popular beliefs, this can be a good thing for equity markets. As you’ll see in the chart below the last 4 periods where the fed raised the short-term interest rates, coincided with some decent equity market returns.

In fact, Covid may have reset it and prolong this bull market for years.

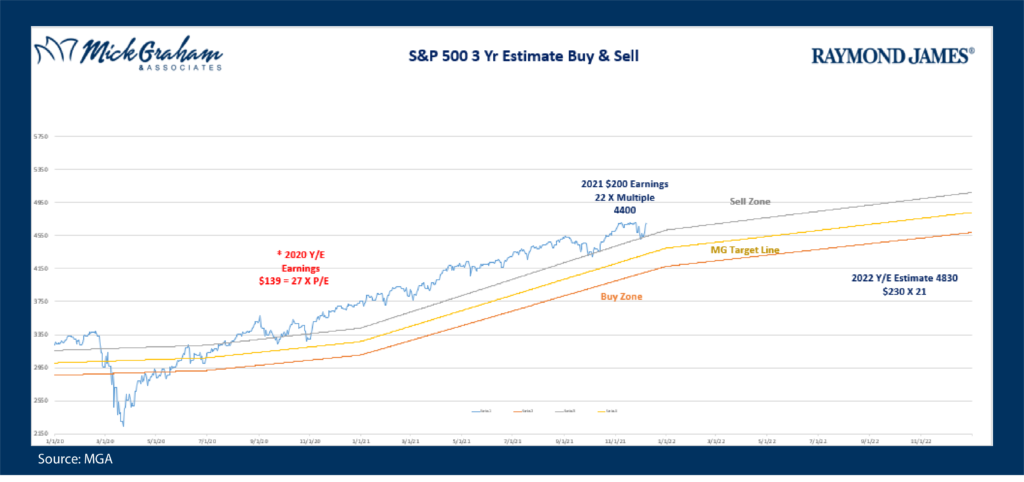

Earnings are still trickling through, and I’m still very encouraged about earnings growth and forecasts. I think earnings for 2022 will be slightly above our $200 price target that we set at the start of the year, with the multiple still elevated around 23 times.

There is volatility amongst some of the innovation stocks, which is totally normal as their price is usually extremely overvalued while investors bet on how far these companies can grow revenue and ultimately profit. We are innovating today so much quicker than any time in history, and this is also one of my catalysts for long term capital market increases. Euphoria in any one name is not the euphoria that ends bull markets.

Long story short, let’s stick with the current game plan of buying support levels (50-Day moving average) and trimming out of single positions when they run to far above our targets, till something else changes our mind.

With that said here’s the buy/sell.

HWFFS

Wealth

I’m going to hit wealth today, if for no other reason than I want to make sure I touch on each of the topics. I don’t want you to think that wealth means the investing thoughts and research I send you each week. It’s much simpler than that.

Wealth is second after health on my mantra, because I believe if you don’t have your health then it can be an expensive exercise and affect the other areas. Wealth is before family, fun and serve, mainly because doing a successful job of this area, can greatly appreciate the quality on the next three.

I’m not referencing a book this week, or even a guru on the topic. I’ll use my own website and pinnacle of our marketing campaign to get new clients. “It’s not rocket science, it’s a process and a discipline”. Now I know I’m preaching to the choir here, because if you hadn’t had a process in the early days of budgeting and saving, as well as the discipline not to stop doing that process, you probably wouldn’t be on this email list. But I still see in today’s day and age, so many believe they have a process, but in reality, it’s chasing their gut feelings. That’s emotional and that’s not a process.

Whether we are talking about your income, expenses, savings, or investments, establishing a process enables you to capture the time-tested wealth strategies, such as compounding, averaging, automation, tax efficacy & risk mitigation…They are all broad terms that can only apply to those with a consistent process. Now everyone’s process is a little different, some better than other. However, the worst process is still better than the best procrastinator and better than the best market timer.

Once you have a process in place, this becomes the hard part. Sit back and watch it work, or as I like to call it “show the discipline”. No one likes to lose a contract, get a pay cut, pay unforeseen expenses, or lose money in investments. But that’s the way the game is played. There are no guarantees in life, but your consistent actions will make the result predictable.

With that, have a great week.

Mick Graham, CPM®, AIF®

Branch Manager Raymond James

Financial Advisor Melbourne, FL

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Mick Graham and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Past performance does not guarantee future results.