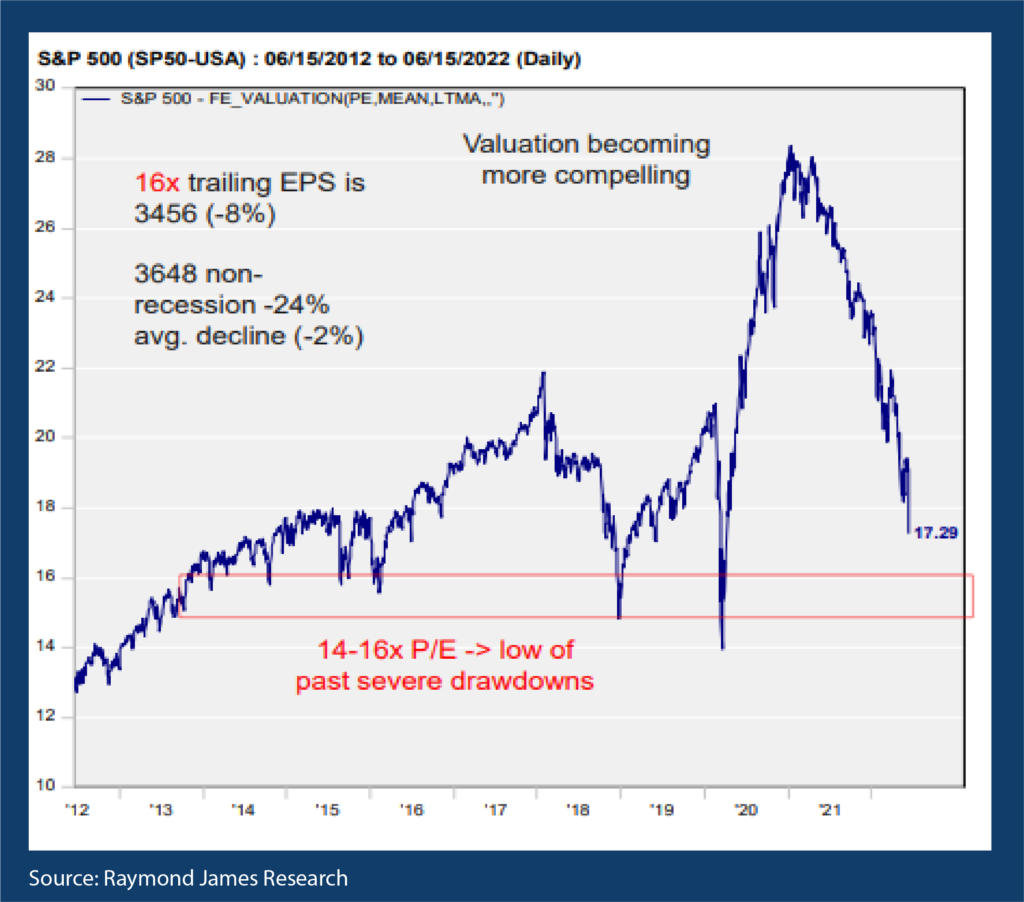

This is painful, any drop is painful, but this one is likely to hurt a little more because it will probably take some time to unwind. Massive amounts of stimulus raised the valuations of the overall index up to pretty extreme levels not seen since the tech crash. We are now at our below long-term average P/E valuations for the S&P 500. When we talk about P/Es people quote two different numbers, and it’s easy to get thrown off by these. There are trailing P/Es, which is the stock price by the earnings over the past 12 months. I’m more concerned with forward P/Es which is the stock price divided by the expected earnings in the next 12 months.

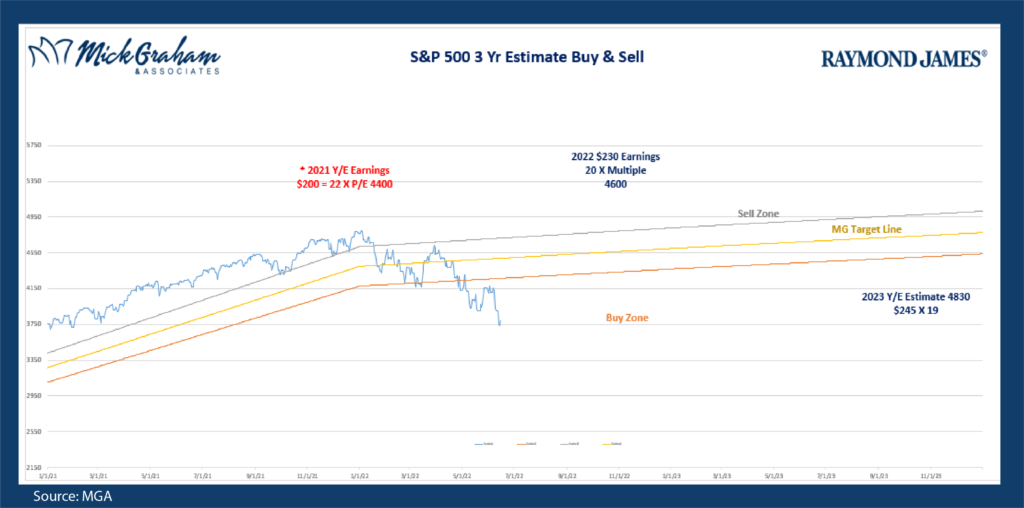

At the end of May, the Forward P/E for the S&P 500 was around 17 times. Given we have dropped another 10% since that date, valuations are now below historical averages. My whole investment thesis revolves around reversion to the mean. That’s why I produce a buy/sell for you. It’s a visual representation of my opinion of when the market is cheap, and when it is expensive.

So, if you are still believing anything I’m writing, your logical next question will be, how much further can it drop? The answer is no one knows that, however, there are some good statistical measures that we can review to help us make an educated assumption. Historically bounces like this have been met with support between 14-16 times trailing. We are starting to touch the 16 times as of the time of writing.

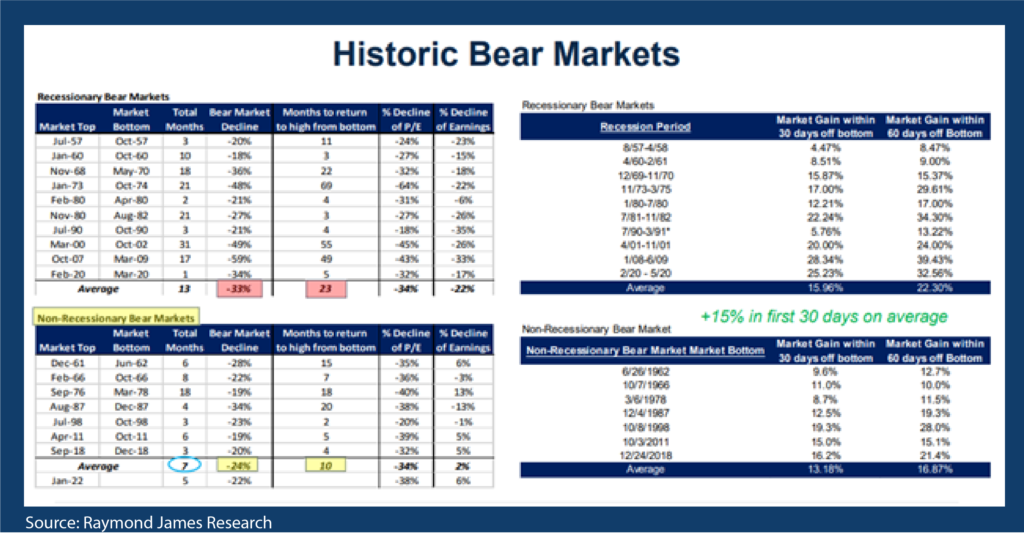

Since we are officially in a bear market, let’s look at the previous times we have been in bear markets and where the bottom was found. First of all, you really need to differentiate between recessionary bear markets and non-recessionary bear markets. The two are very different as you will see below. I’ll throw another one in and that’s a mild recession.

My base case scenario is that economic growth will be positive in the second half of the year, and in that light–we do not enter a recession (2 negative quarters of GDP) the bottom chart shows that the average Non-Recessionary bear market averages a 24% drop, takes 7 months to get there and takes 10 months to go back to all time highs.

Should we enter a full recession, the average drop from highs is 33%, takes 13 months to get there and 23 months from the bottom to get back to all time highs.

To determine whether we enter a recession, mild recession or don’t have one at all, is more determined on fed actions than anything else right now. In 2018 Chairman Powell said that he would continue to raise rates, and we were nowhere near normalized rates. We subsequently dropped a quick 20% right before Christmas of that year. I do believe he learnt his lesson from that time. I also interpret his recent comments as more sensitive to the data, than he has been in the past.

For those who are thinking about withdrawing funds at this time let me say this. Yes, you may be right, and this market may go down more from here. However, trying to time markets at this time is like juggling fire. You might catch a few, but unless you’re really good, or extremely lucky, you’ll get burnt. When we do hit the bottom of this leg down, the move back up is often very swift. You’ll see from the right side of the chart, that the average bounce off the bottom is 16% from recessionary bounces and a bit over 13% for non-recessionary bounces. My opinion is that you can’t afford to be on the sideline through this period. If you have extra cash to invest, I’ll say is the risk/reward on investing in equities looks a heck of a lot better that it did 6 months ago.

As we sit here today, there is not a great deal of data that will support a big rally unless we get a cease fire or an easing of the China (zero Covid) policy. We will need to wait another month for the inflation read. So, it may be a little bumpy from here, but I am looking to take advantage of some cheap valuations from here.

With that said, here is the buy/sell.

Mick Graham, CPM®, AIF®

Branch Manager Raymond James

Financial Advisor Melbourne, FL

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

Any opinions are those of Mick Graham and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained in this material does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation.