I don’t often give you a mid-week update but given the volatility we are seeing and the fact that I’m starting to get calls and emails from you…I wanted to give you my thoughts, game plan and a few tactics to help you through these times.

You guys are great barometers. You are very disciplined investors. Meaning if you call concerned about the market then it’s got a lot of your attention. You know when you write to me that the response you are going to get from me will sound something like this. “Things are starting to go on sale.” “The valuation of the market is starting to make sense now”. “Now I’m getting excited”. Knowing this is likely the response you’re going to get, it must take a lot for you to write anyway.

Yes, I’m reinstating my quotes above, but I’ll give you some reasoning behind it. The market will return to all-time highs again, it’s just a matter of when. If you need the money in the next 12-24 months, then you may consider cashing out. If not…keep reading.

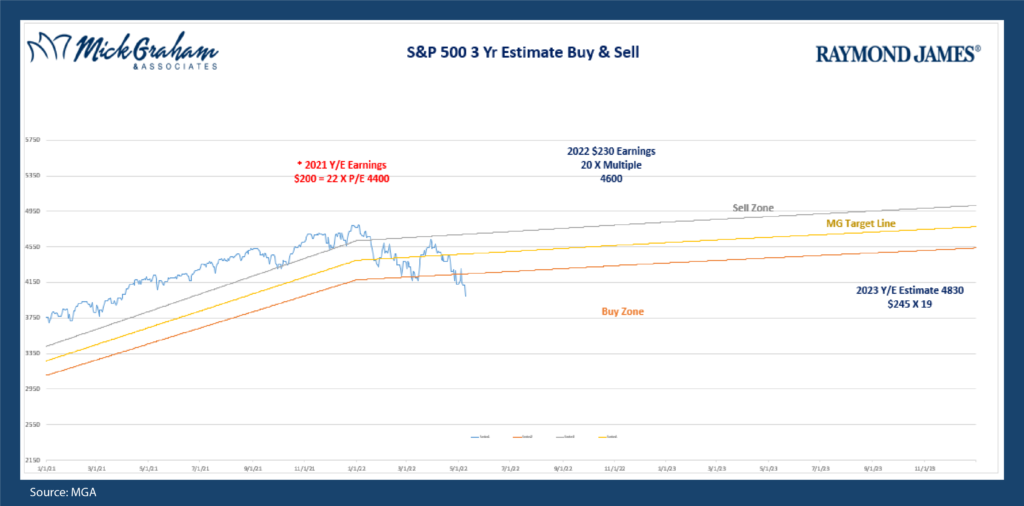

You know the market got ahead of itself since the massive amount of stimulus was pumped into the economy. Multiples went through the roof and it was just generally expensive, which is what my Buy/Sell has been telling you all along. Markets do this. They overshoot on the upside and on the downside. Think about it like trying to walk a tightrope. The wind pushes you one way, you then adjust and sometimes over adjust to the other. You do that a few times and you eventually get back to equilibrium.

Don’t look at it as Dollars and Cents. Look at it as percentages. This is how the Pros do it. This is how I do it (yes, I’m throwing myself in the Pros column). If I were to look at the total amount of dollars lost collectively when markets take a tumble, then I would’ve never got an office on the 5th floor. Then, once you know the percentages, measure it against your respective benchmark. If you’re all stock, measure the S&P 500. If you’re a blend, measure it against a 50/50 mix of S&P 500 & the Barclays Bond Agg. If you’ve lost money, this is how you measure it. (e.g., if an account is down 10%, the S&P 500 is down 12%, yes, you’re out in front.) I know that’s hard to get yourself to do, but it’s true numbers you should be concerned about, not from the high-water mark of your account balance. Why? I’ll give you two good reasons.

First, because when you invest in the stock market, (in a diversified manner), you are looking to get index returns over a long period of time, not on the time period from when your account hit its peak. Second, because if you are trying to beat an index over a long period of time then the times it goes down can provide a great opportunity to beat the index. When you’re managing a portfolio, trying to beat an index, it’s really hard to do it when everything is going up. The way the retail investor puts money to work means we can only be 100% long. (Meaning I can only invest 100% of your money). When markets rally, it’s hard to keep up. However, I don’t need to be 100% long, meaning I can hold some cash. When markets go down, you may not go down as much so it creates an opportunity to miss a little bit of the pain and then put that cash to work when everyone else is looking for the exit sign.

OK. Let’s now talk about macro issues affecting the markets and why I think this is now looking attractive. The market volatility (I would strongly argue) is based on inflation scares. It’s been a long time since we’ve had inflation above 2%, and frankly the guys who were around when it was above that level have mostly retired or should’ve already. The Fed pumped so much money into the economy to stimulate it through Covid that inflation was inevitable. If you give us all money, and take away the amount of things we can buy, what else would happen? Again, I would argue that the market today is pricing that inflation will continue to rise. I’m starting to see some different shifts. Here are a few encouraging metrics:

- Wage growth is now at 3%. It was 6% in December.

- Earnings are great. (Remember, it always comes back to earnings eventually). I’m really encouraged by earnings growth and the slight reduction in estimates.

- Amazon said in its earnings call that they are oversupplied with labor. That means that even though we have seen a reduction in wage growth, it’s likely to reduce further.

- The U.S. consumer is very healthy. We still have record balances in checking accounts.

- Economic growth is a good thing. We need inflation. The market wants steady as she goes inflation and is worried will the Fed raise so much as to put the economy in a recession.

- Supply is catching up and we seem to be operating at a high capacity.

- I don’t see any Euphoria in the markets. See Sir John Templeton’s quote…

All in all, my view is that we have seen peak inflation. I believe the market is pricing in too much concern for both inflation and the Feds reaction to it. I’m looking for the data to support this over the coming weeks, and if I’m right I think we could see a significant rally, albeit with different leadership. Energy has worked well this year and everything else has not. That could well reverse pretty quickly.

We become victims of technical analysis during these high volatility times. The next level of support for the market would be around 3800 on the S&P 500, which is another 4.5% or so from here. It’s quite possible we see it, which will just make me all the more bullish.

Here’s a quick look at the buy/sell.

As always feel free to call with any questions.

Mick Graham, CPM®, AIF®

Branch Manager Raymond James

Financial Advisor Melbourne, FL

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Mick Graham and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. The forgoing is not a recommendation to buy or sell any individual security or any combination of securities. Holding stocks for the long-term does not insure a profitable outcome. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including asset allocation and diversification. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Any hypothetical examples are for illustration purposes only and do not represent an actual investment.